Tag: apple

-

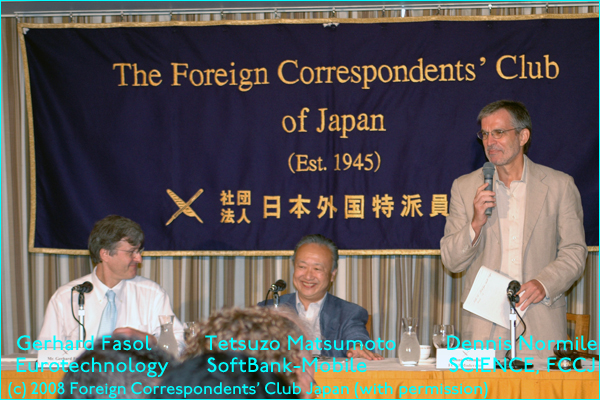

Will the iPhone trigger a turning point in Japan’s mobile phone industry?

Tetsuzo Matsumoto (Senior Executive Vice-President and Board Member of SOFTBANK MOBILE Corporation),Gerhard Fasol (CEO, Eurotechnology Japan KK)andDennis Normile (Japan Correspondent of SCIENCE Magazine, and FCCJ)discuss about the future of Japan’s mobile phone market. “Will the iPhone trigger a turning point in Japan’s mobile phone industry?”(Foreign Correspondents’ Club of Japan, Tokyo Wednesday, August 13, 2008, 12:00-14:00)(Photo:…

-

iPhone? iTunes/iPod phones?

There is a lot of discussions about whether Steve jobs is going to announce an iPhone or iPod-Phone at the Apple Computer Developer’s Conference in SF – according to the headline report on Saturday May 13th, 2006 in Nihon Keizai Shinbun ( the world’s largest business daily ) it’s already known since May this year…

-

SoftBank a small fry??

In my 20 years of business and work between US/Japan and EU/Japan, I am often surprised how Western executives underestimate economic size and strength of Japan and it’s companies – here is another example: BusinessWeek writes about the SoftBank/iPod phone, and writes that former Apple executives says that Apple’s CEO Steve Jobs wouldn’t normally tie…