Tag: galapagos

-

Japan Galapagos Effect – How to capture global value for Japan? Keynote for the American Chamber of Commerce in Japan (ACCJ) by Gerhard Fasol

Japan Galapagos Effect – how to capture global value for Japan. From the Journal of the American Chamber of Commerce in Japan (ACCJ), reproduced with permission. Dr. Gerhard Fasol dissects the history behind Japan’s unique international market separation By Hugh Ashton Originally posted by ACCJ Journal on January 15, 2011 in “Chamber Events” based on…

-

Japan technology companies – the future?

Japan technology companies – how to move to the future? Gave a talk to a group of about 50 CEOs of the Japan subsidiaries of global companies on the topic “A future for Japan’s tech companies?” I talked about the same issues as at the TTI-Vanguard Forum about a year earlier, and started again with…

-

Paradigm change of the global mobile phone business and opportunities for Japanese mobile phone makers

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

Will the iPhone trigger a turning point in Japan’s mobile phone industry?

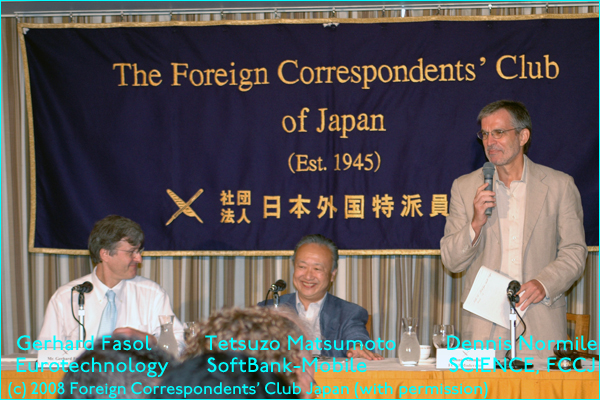

Tetsuzo Matsumoto (Senior Executive Vice-President and Board Member of SOFTBANK MOBILE Corporation),Gerhard Fasol (CEO, Eurotechnology Japan KK)andDennis Normile (Japan Correspondent of SCIENCE Magazine, and FCCJ)discuss about the future of Japan’s mobile phone market. “Will the iPhone trigger a turning point in Japan’s mobile phone industry?”(Foreign Correspondents’ Club of Japan, Tokyo Wednesday, August 13, 2008, 12:00-14:00)(Photo:…

-

Japan’s Mobile Phone Industry and u-Japan (Talk announcement)

Title: “Japan’s Mobile Phone Industry and u-Japan” Date and Time: Thursday, 12th October 2006, 17:00-19:00 Location: Main Conference Room 4F, EU-Japan Centre for Industrial Cooperation, Tokyo Agenda: Japan’s mobile phone and broad-band markets are about 3-6 years ahead of Europe: new services are typically invented or first brought to market in Japan, 3-6 years earlier…

-

Why Japan is several years ahead of Europe in telecoms…

Briefing the EU Attaches at the EU Embassy in Tokyo about the reasons behind Vodafone’s departure from Japan The deeper reasons and background on why Vodafone failed in Japan Today (March 23, 2006) I was invited to brief the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo about Japan’s…

-

Why are keitai so hot in Japan?

Seminar announcement The European Institute of Japanese Studies (EIJS Academy in Tokyo) of the Stockholm School of Economics will hold a seminar in Tokyo-Marunochi on Thursday, February 16, 2006: Topic: “Why are Mobile Phones (Keitai) so hot in Japan? – and How European companies in all sectors can profit from Keitai” Speaker: Gerhard Fasol Agenda:…

-

New opportunities versus old mistakes in Japan

Foreign companies in Japan’s high-tech markets Stanford University US-Japan Technology Management Center Autumn 1999 Seminar Series: ” The Transformation of R&D in East Asia and Japan” Thursday, October 28th, 1999: 16:15pm US-Japan Technology Management Center, (Skilling Lecture Theatre) (was transmitted by Stanford’s TV to 100s of Silicon Valley companies) Copyright 2013-2019 Eurotechnology Japan KK All…