Gerhard Fasol. news. events.

-

Japan’s Chief Cabinet Secretary Takeo Kawamura (河村建夫) gave a speech at the Foreign Correspondents Club on December 17th, 2008. Kawamura is born in Hagi (Kawaguchi-ken – a beautiful Castle Town in the west of Japan’s main island, which is also host to many famous potters). Kawaguchi was Education Minister in Prime Minister Aso’s cabinet. In…

-

presentation by Gerhard Fasol, at the Industry Association of Japanese telecom and networking equipment makers, Friday November 27, 2008, 15:00-16:30 Presentation was fully booked several weeks before the talk, attended by about 100 managers and executives of Japan’s telecom equipment makers, and included also the Vice-Minister/Secretary of State of Japan’s General Affairs Ministry, which is…

-

Nomura CEO, Kenichi Watanabe, today gave a presentation about the acquisition of the former Lehman Brothers operations in Europe & ME, Japan, Asia (ex-Japan) and in India. Nomura acquired: Europe and ME: Equities and investment banking operations (approx 250 people) Fixed income staff (approx 150 people) Japan: approx. 1100 people Asia (ex-Japan): approx. 1500 people…

-

Modo Gakuen Cocoon Tower in Tokyo Shinjuku (モード学園コクーンタワー) Purpose: shared by three Universities and schools, and others 4 underground floors + 50 above ground floors building started: May 1, 2006 opened: October 15, 2008 Architects: Tange Associates (丹下都市建築設計) Building company: Shimizu (清水建設) Copyright (c) 2013 ·Eurotechnology Japan KK All Rights Reserved

-

Stuart Chambers, CEO of NSG Group, gave a press conference on October 16, 2008, here are some notes and thoughts. On February 16th, 2006, Nippon Sheet Glass’ offer for the 80% of Pilkington plc it did not already own, for US$ 3.14 billion in total, was accepted by Pilkington’s share holders and the acquisition was…

-

Presentation at the CEATEC Conference, talk NT-13, Meeting Room 302, International Conference Hall, Makuhari Messe, Friday October 3, 2008, 11:00-12:00. See the announcement here [in English] and in Japanese [世界の携帯電話市場のパラダイム変更と日本の携帯電話メーカーのチャンス] The emergence of iPhone, Android, open-sourcing of Symbian, and the growth of mobile data services are changing the paradigm of the global mobile phone business…

-

The candidates for the next President of the LDP (Liberal Democratic Party) of Japan presented their views and answered questions at the FCCJ in Tokyo to the foreign press. An LDP party electoral college (387 Diet members + 141 regional representatives, in total 528 votes) will vote to select the president on September 22, 2008,…

-

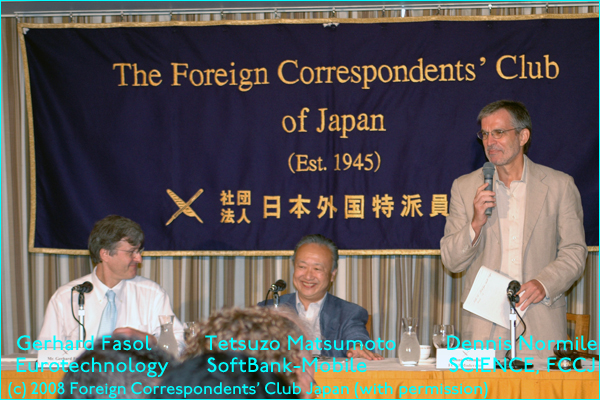

Tetsuzo Matsumoto (Senior Executive Vice-President and Board Member of SOFTBANK MOBILE Corporation),Gerhard Fasol (CEO, Eurotechnology Japan KK)andDennis Normile (Japan Correspondent of SCIENCE Magazine, and FCCJ)discuss about the future of Japan’s mobile phone market. “Will the iPhone trigger a turning point in Japan’s mobile phone industry?”(Foreign Correspondents’ Club of Japan, Tokyo Wednesday, August 13, 2008, 12:00-14:00)(Photo:…

-

German Embassy in Tokyo April 24th, 2008 Title: A German Perspective on M&A in Japan The background, the drivers: High Euro, low valuations in Japan Globalization, must have critical size Technology Europe’s business is under-developed in Japan The Landscape: M&A is generally at lower levels than in UK/US recently M&A transactions are rising: Types of…

-

Talk and panel discussion at the Daiwa Anglo-Japanese Foundation Practical aspects of mergers and acquisitions between Europe and Japan Gave a panel talk organized by the Asia Pacific Technology Network at the beautiful House of the Daiwa Anglo-Japanese Foundation near Regents Park in London on the topic “M&A in Japan” on April 18th, 2008. Summary:…