Japan’s future: Bill Emmott and Gerhard Fasol

Bill Emmott is an independent writer and consultant on international affairs, board director, and from 1993 until 2006 was editor of The Economist. http://www.billemmott.com

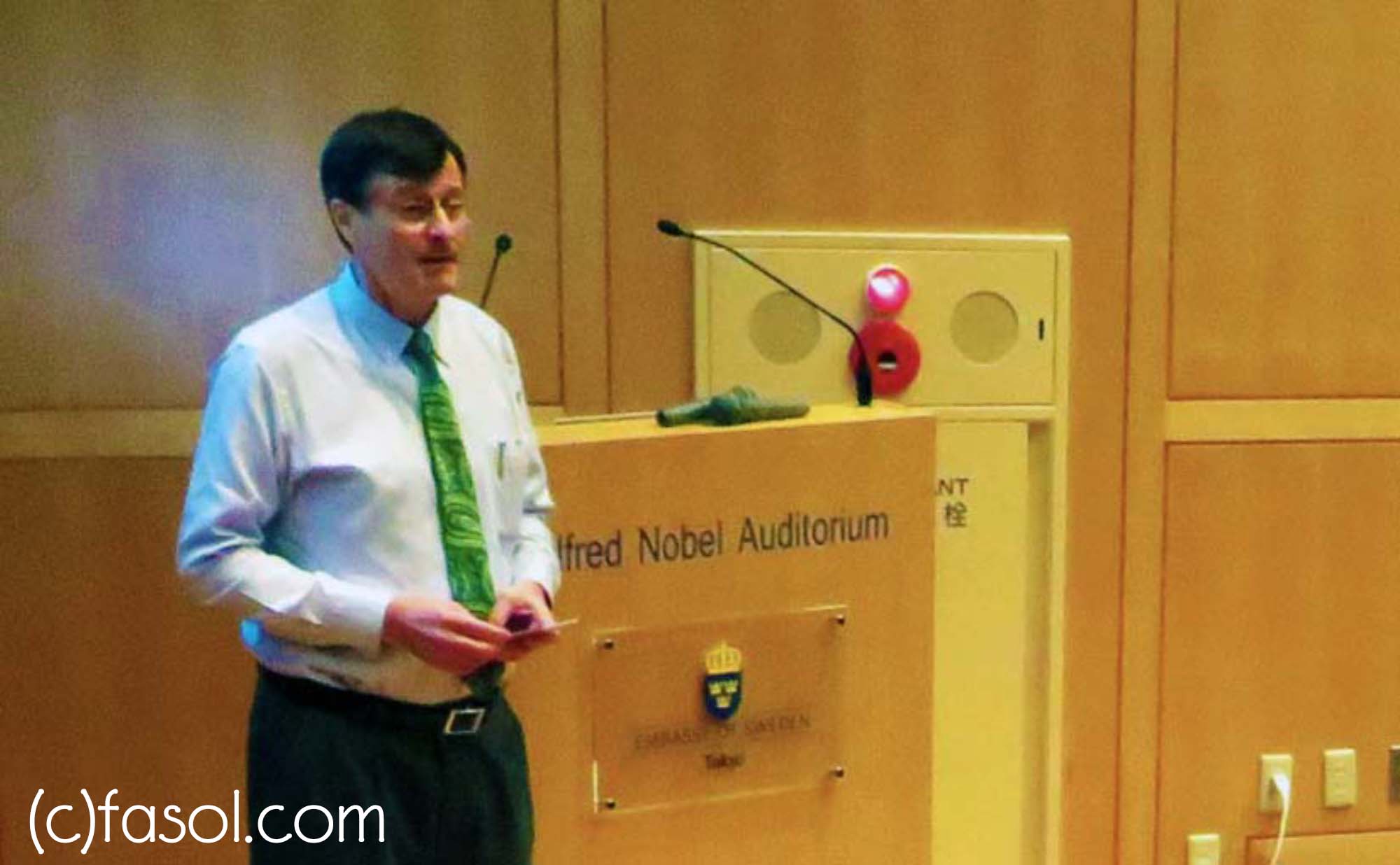

Gerhard Fasol is physicist, board director, entrepreneur, M&A advisor in Tokyo. https://fasol.com/

Japan’s future: A conversation

Bill Emmott:

I came first to Japan in 1983 as Economist Tokyo Bureau Chief, staying until 1986. Then in 1988 I came back on sabbatical leave and wrote “The sun also sets: why Japan will not be number one”, which against my expectation when it was published in 1989 found big resonance in Japan. The stock market was plunging, and mine was the most immediately available explanation. Ever since, journalists have constantly asked me what the sun is doing now! It also meant that even when I became editor in chief of The Economist in 1993 I spent much more time focused on Japan than I had expected, visiting as often as I could to keep track of the post-bubble developments, and wrote a book that appeared only in Japanese translation called “Kanrio no Taizai”, or the bureaucrats’ deadly sins. But later, with Prime Minister Koizumi consolidating reforms, and the banking system at last getting cleared up, I sent myself back in 2005 to research and wrote a much more optimistic special supplement for The Economist which became a book, “The sun also rises”.

Throughout the 35 years since I first came to Japan, I have both been fascinated and struck by the fact that although this is in so many ways an inward-looking self-contained nation, foreign observers are listened to and even have a chance of having a positive impact.

One element that had featured consistently in my writings ever since the 1980s had been observations and expectations for a growing role for women in employment and power. This seemed logical given that, at least before the bubble burst, Japan was heading for a labour shortage, but also the Equal Employment Law of 1986 had led to more females being recruited by major organisations. Japan’s excellent education surely meant that the underused half (= women) of the adult population would soon be used more productively.

Of course, this has developed a lot more slowly than I expected or hoped, partly for cultural reasons but also because Japan has not in fact had a labour shortage, until now.

I wanted to meet you, Gerhard tonight because we both are fascinated by the role Japanese women have in making Japan such a fascinating country, and how the many really strong Japanese women could have key roles in bringing growth and dynamic change back to Japan.

- Could Japanese women have bigger roles for the development of Japan?

- What is holding women back in Japan?

- Who are the role models?

I am making interviews with high-achieving Japanese women to try to find answers, and plan to compile them into a book later this year. What would you say, Gerhard? And anyway, how did you end up here?

Gerhard Fasol:

My path to Japan is quite different than yours, Bill. I came to Japan first in 1984 as Fellow of Trinity College Cambridge, and scientist at the Max-Planck-Institute in Stuttgart, part of a project to build a research cooperation with NTT’s R&D labs. I saw that Japan was very important in technology and weakly linked to the outside – and still is today, I think. So in 1984 I decided to make Japan my second professional focus in addition to physics and electronics. Like you – the deeper I get into Japan, the more I learn about Japan, the greater my fascination, and my motivation to contribute.

Now I am working on many different projects, working on international technology M&A projects, and I am also one of a microscopic number of foreigners on the Board of Directors of a stock market listed Japanese corporation – reforming Japanese corporate governance hands-on.

Could Japanese women have bigger roles for the development of Japan?

Gerhard Fasol:

I think that the equal participation of women in leadership is directly linked to the population issue, ie the number of children born.

According to the Inter-Parliamentary Union in 2016 http://data.worldbank.org/indicator/SG.GEN.PARL.ZS

- in Japan 10% of Members of Parliament were women,

- while in Sweden 44% of Members of Parliament are women,

- 37% in Germany and

- 26% in France –

- the world average is 23% women in Parliaments.

In Japan the ratio of women in Parliament has increased from 1% in 1990 to 10% in 2016, so there is progress. If we extrapolate, and if the trend continues, then it might take another 30 years or so until Japan reaches world average in terms of women bringing women’s views into Parliament, and taking part in making the laws. And it might take Japan 100 years to reach Scandinavian standards of women’s participation in making the laws of the land – unless there is some acceleration in Japan.

Japan’s most powerful Ministry, the Ministry of Finance, did not hire any women into career positions for a period of about 10 years!

At the 2015 New Year event of Kyoto Bank, Keidanren Chairman Mr Sadayuki Sakakibara showed that Japan’s spending on aged people is dramatically higher than spending on children, and that this ratio is increasing with time, Japan spends more and more on aged people and less and less on children. There are two ways to look at this situation:

- one way is to say: we have an aging society, therefore its only natural to spend more on

the aged, and less for children - the opposite way to look at the same situation is to say: we are spending less and less for children, no wonder we have fewer and fewer children. If we did more for young people, maybe people will have more children….

Actually most Japanese women I talk to want 2-3 children, but many cannot for financial reasons.

By nature, women give birth to children, not men, so more women in decision making positions including Government and Parliament will bring children’s issues into decision making.

As an example, child birth costs in Japan are not covered by health insurance, while they are everywhere in Europe. There are many other open and hidden costs of having children in Japan compared to Europe.

We discussed some of these issues at the recent Ludwig Boltzmann Forum on women’s development and leadership, which I organized here in Tokyo https://www.boltzmann.com/2016/05/ludwig-boltzmann-forum-women-leadership-2016/

What is holding women back in Japan?

Gerhard Fasol:

The most important factor are mindsets. The key to give more power to women in Japan is to change mindsets, to change the way of thinking.

As an example, the Prefecture of Kanagawa in 2015 created the “woman act” committee, under the slogan “women, step by step, take more responsibility”, however this committee both in 2015 and also in 2016 consisted of 11 men – not one single woman leader – here with original photographs archived on the wayback-machine / internet archive

https://web.archive.org/web/20160119091535/http://www.pref.kanagawa.jp/osirase/0050/womanact/#top

Why not create a committee of 11 women leaders to lead efforts on gender equality in Kanagawa Prefecture? Why not promote women to leadership positions in Kanagawa Prefecture?

Another factor holding women back are the very long working hours common in Japan. As an example, at a recent EU-Japan gender equality conference, the Danish polician Astrid Krag, who was Minister for Health and Prevention at the age of 29 – 32 years, and who has two children, explaned that in the Parliament of Denmark the decision was taken not to take any vote after 4pm, so that Members of Parliament can be back home by 5pm, collect children from daycare centers in time etc. So in the Parliament of Denmark it is guaranteed that Members of Parliament can leave at 4pm. In today’s Japan such action is unthinkable, age 29 – with young children – would be unbelievably young for a Government Minister in Japan. https://en.wikipedia.org/wiki/Astrid_Krag

Late-night or overnight sessions at work, including Parliament, makes life incredibly difficult in Japan for parents with young children, doubtlessly contributing to the small number of women in top positions in Japan.

Who are the role models?

Gerhard Fasol:

Despite these difficulties, there is a substantial number of very strong women in Japan, who have worked their way up into leadership positions.

Examples are the Mayor of Yokohama, Ms Fumiko Hayashi, who succeeded in a very distinguished business career, and the Governor of Tokyo, Ms Yuriko Koike, who won the election on her own as an independent candidate, because she did not receive the backing of her party.

Bill Emmott:

That is great, as I have now interviewed Koike-san and plan to interview Hayashi-san during my next visit. Personally, as well as admiring women who have made it to the top in the tough political world I also admire and am interested in women succeeding as entrepreneurs and as executives in entrepreneurial companies. By starting and building their own companies, women can really create new realities, showing that new organisational cultures are possible in a Japanese context. Do you agree?

Gerhard Fasol:

Japan has quite a number of women entrepreneurs and business leaders, Ms Tomoko Namba, Founder of Japan’s Internet company DeNA come to mind,

https://ja.wikipedia.org/wiki/南場智子

as well as Ms Fujiyo Ishiguro, Founder and CEO of the NetYear Group:

http://www.bloomberg.com/research/stocks/people/person.asp?personId=867078&privcapId=717286

Science is also an interesting area. We have women leaders in Japanese medicine, I invited some for the Ludwig Boltzmann Forum on women’s development and leadership https://www.boltzmann.com/2016/05/ludwig-boltzmann-forum-women-leadership-2016/

Kyushu University has one single full Professor of Medicine Professor Kiyoko Kato, she explains the situation of women in Japanese Obstetrics and Gynecology here https://www.boltzmann.com/2016/05/kiyoko-kato/

while Professor Kyoko Nomura has built a center to support women medical doctors and women medical researchers at Teikyo University. She spoke about the situation facing women in medicine in Japan here: https://www.boltzmann.com/2016/02/kyoko-nomura-2/

Towards the future

Gerhard Fasol:

The tantalizing issue is that the key is to change mindsets, and thats at the same time superficially easy, but at the same time incredibly hard. Thus outstanding strong Japanese women – and there are many of them – have a choice either to work their way up to the top in Japan, start their own company in Japan, or on the other hand to move to Europe, elsewhere in Asia, or to the USA – I know several strong Japanese women, including several Japanese medical doctors, who have moved to Europe or USA. They might of course come back to Japan at a later stage bringing global views and experiences to leadership positions in Japan in the future. I am very optimistic for the future of Japan – sometimes I wish things were moving faster.

Bill Emmott:

I agree entirely. I see Japanese women as both victims of the slow speed of change and as solutions to it. They really could make the Japan of 2030 look quite different, in all sorts of ways. It will be fascinating to watch.

Bill Emmott and Gerhard Fasol met at the restaurant MusMus in Tokyo

Copyright (c) 2017 by Bill Emmott and Gerhard Fasol. All Rights Reserved.