Category: Uncategorized

-

Growing your business in Japan (video conference) 31 January 2023

Despite being the world’s third largest market, many businesses struggle to break into Japan. The “Growing your Business in Japan” free webinar, organized by the SCI’s Science and Enterprise Group and powered by LabLinks, will provide valuable insights into the challenges of growing a chemistry-facing business in the Japanese market, and how they can be overcome. The host, Dr Alan Steven – Chief…

-

![[Trinity Japan] Professor Mauro Guillén, Dean of the Cambridge Judge Business School (11 February 2022)- “How today’s biggest trends will collide and reshape the future of everything”](https://www.fasol.com/b/wp-content/uploads/2022/04/GUILLEN_Mauro-5_HighRes_HDR.jpeg)

[Trinity Japan] Professor Mauro Guillén, Dean of the Cambridge Judge Business School (11 February 2022)- “How today’s biggest trends will collide and reshape the future of everything”

Professor Mauro Guillén, Dean of Cambridge Judge Business School since 2021, in discussion with Trinity Japan moderated by Gerhard Fasol Dean of Cambridge Judge Business School since 2021Professor of Management StudiesFellow of Queens’ College Details: (c) 2022 Gerhard Fasol. All Rights Reserved

-

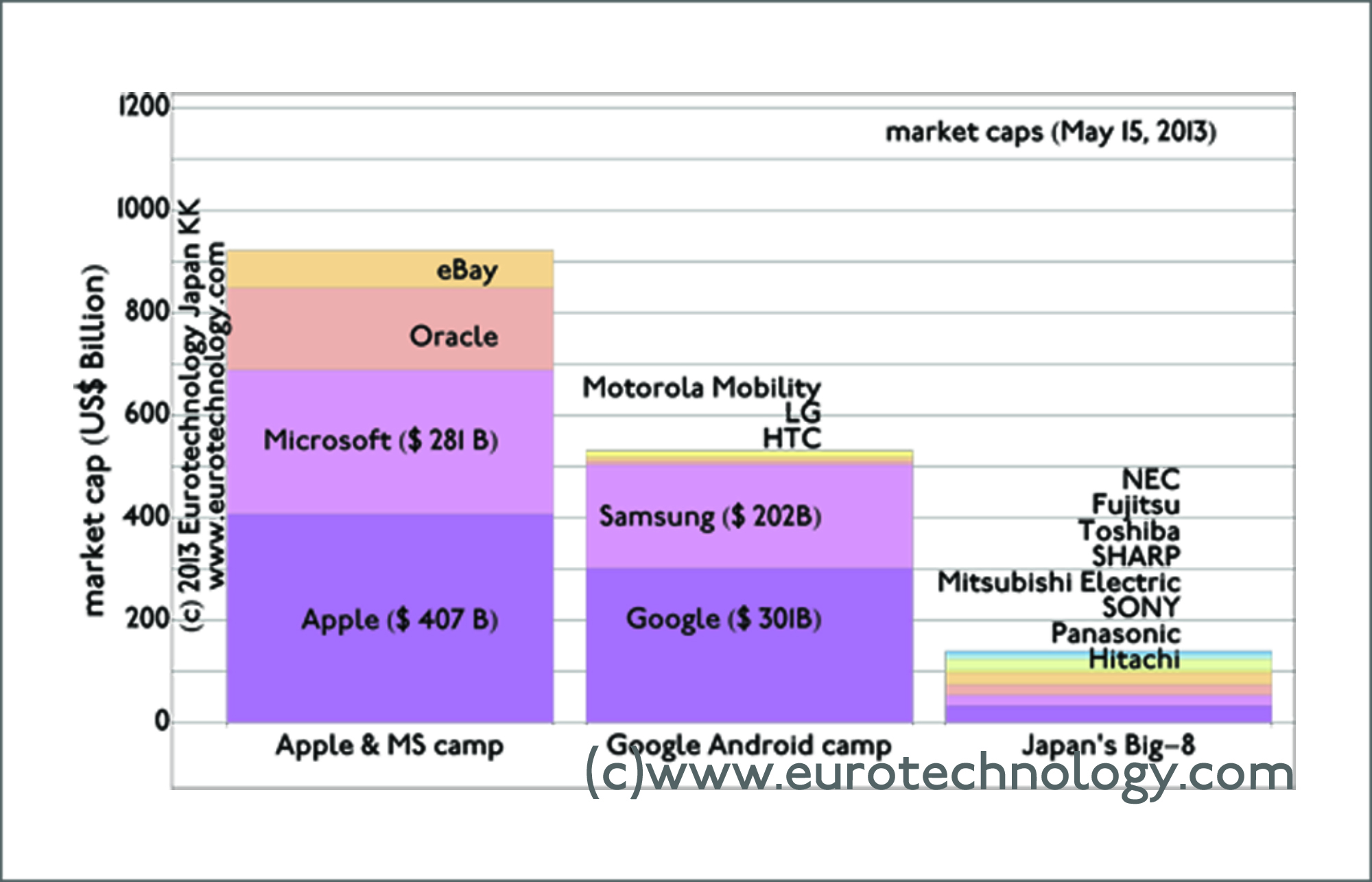

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…

-

Japan’s tech companies need to restructure – CNBC March 27, 2012

https://www.cnbc.com/video/2012/03/27/japans-tech-companies-need-to-restructure.html Japan’s electronics industries – research report

-

Japan’s Mobile Phone Industry and u-Japan (Talk announcement)

Title: “Japan’s Mobile Phone Industry and u-Japan” Date and Time: Thursday, 12th October 2006, 17:00-19:00 Location: Main Conference Room 4F, EU-Japan Centre for Industrial Cooperation, Tokyo Agenda: Japan’s mobile phone and broad-band markets are about 3-6 years ahead of Europe: new services are typically invented or first brought to market in Japan, 3-6 years earlier…