Category: M&A

-

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

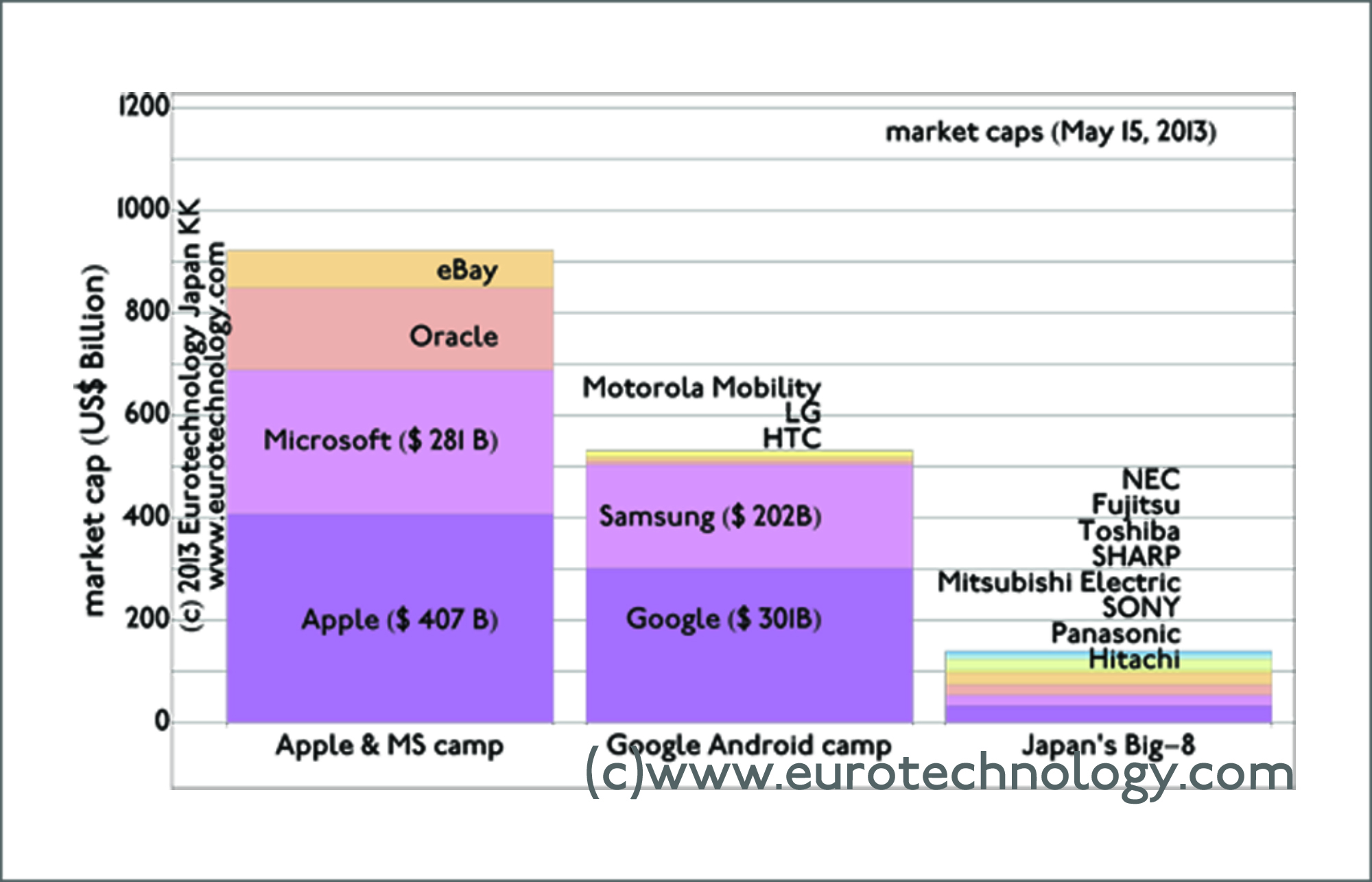

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…

-

Four critical factors for Japanese corporates making major international acquisitions, Stuart Chambers, CEO of NSG Group

Stuart Chambers, CEO of NSG Group, gave a press conference on October 16, 2008, here are some notes and thoughts. On February 16th, 2006, Nippon Sheet Glass’ offer for the 80% of Pilkington plc it did not already own, for US$ 3.14 billion in total, was accepted by Pilkington’s share holders and the acquisition was…

-

A German perspective on M&A in Japan

German Embassy in Tokyo April 24th, 2008 Title: A German Perspective on M&A in Japan The background, the drivers: High Euro, low valuations in Japan Globalization, must have critical size Technology Europe’s business is under-developed in Japan The Landscape: M&A is generally at lower levels than in UK/US recently M&A transactions are rising: Types of…

-

M&A in Japan

Talk and panel discussion at the Daiwa Anglo-Japanese Foundation Practical aspects of mergers and acquisitions between Europe and Japan Gave a panel talk organized by the Asia Pacific Technology Network at the beautiful House of the Daiwa Anglo-Japanese Foundation near Regents Park in London on the topic “M&A in Japan” on April 18th, 2008. Summary:…

-

A European perspective on M&A in Japan

Presentation at the lunch meeting of the Danish Chamber of Commerce in Japan (DCCJ) on April 4, 2008. Announcement Photos of the event Announcement text: With the very high EURO and low valuations of many Japanese companies, and with changing attitudes in Japan, now is an excellent time for European companies to start or expand…

-

Trends in high technology in Japan (EU mission on foreign direct investment in Japan)

The EU-Japan Center for Industrial Cooperation held a 5-day intensive course in Japan for executives from EU firms between Monday 19th February – Friday 23rd February, 2007 on foreign direct investment in Japan. On Monday 19th February I gave a talk “Trends in high technology in Japan”, covering the following points: “Japan is a technology…

-

“New Opportunities versus Old Mistakes: European Companies in Japan’s High-Tech World”

Gerhard Fasol gave a talk at the EU-Japan Center for Industrial Cooperation (Tokyo) on Thursday, June 22nd, 2000, 14:00-16:00, and Thursday, December 7th, 2000, 14:00-16:00 Topic: “New Opportunities versus Old Mistakes: European Companies in Japan’s High-Tech World” (Audience: 70 Presidents, VPs, and managers of Japan subsidiaries of European Companies and Banks.)

-

Trends, Opportunities and Change in Japan’s High-Tech World

Gerhard Fasol gave a talk at the French Embassy in Tokyo on Tuesday, September 28, 1999 at 18:30pm. Topic: “Trends, Opportunities and Change in Japan’s High-Tech World” (in French language) Purpose: Executive Education for management of French Subsidiaries in Japan Participants: Executives of French subsidiary companies in Japan

-

“New Business Opportunities in Japan – the world’s second largest market”

Gerhard Fasol gave a talk at the Rotary Club Stuttgart-Solitude on Monday, September 6th, 1999, 18:30pm Topic: “New Business Opportunities in Japan – the world’s second largest market” (Audience: CEOs, Managers, VPs, of Stuttgart area companies)