Category: Electronics industry

-

Japan’s globalization paradox: is Japan global? or struggling to globalize?

Japan’s globalization puzzle: intriguing questions by one of my great European friends, a great European banking sector leader How do you explain Japan’s lack of internationalization with so many big Japanese holdings managing successfully businesses abroad (e.g. Toyota, Toshiba, Mitsubishi, etc.) Japan’s globalization paradox – a closer look Its not so simple: Japan is a…

-

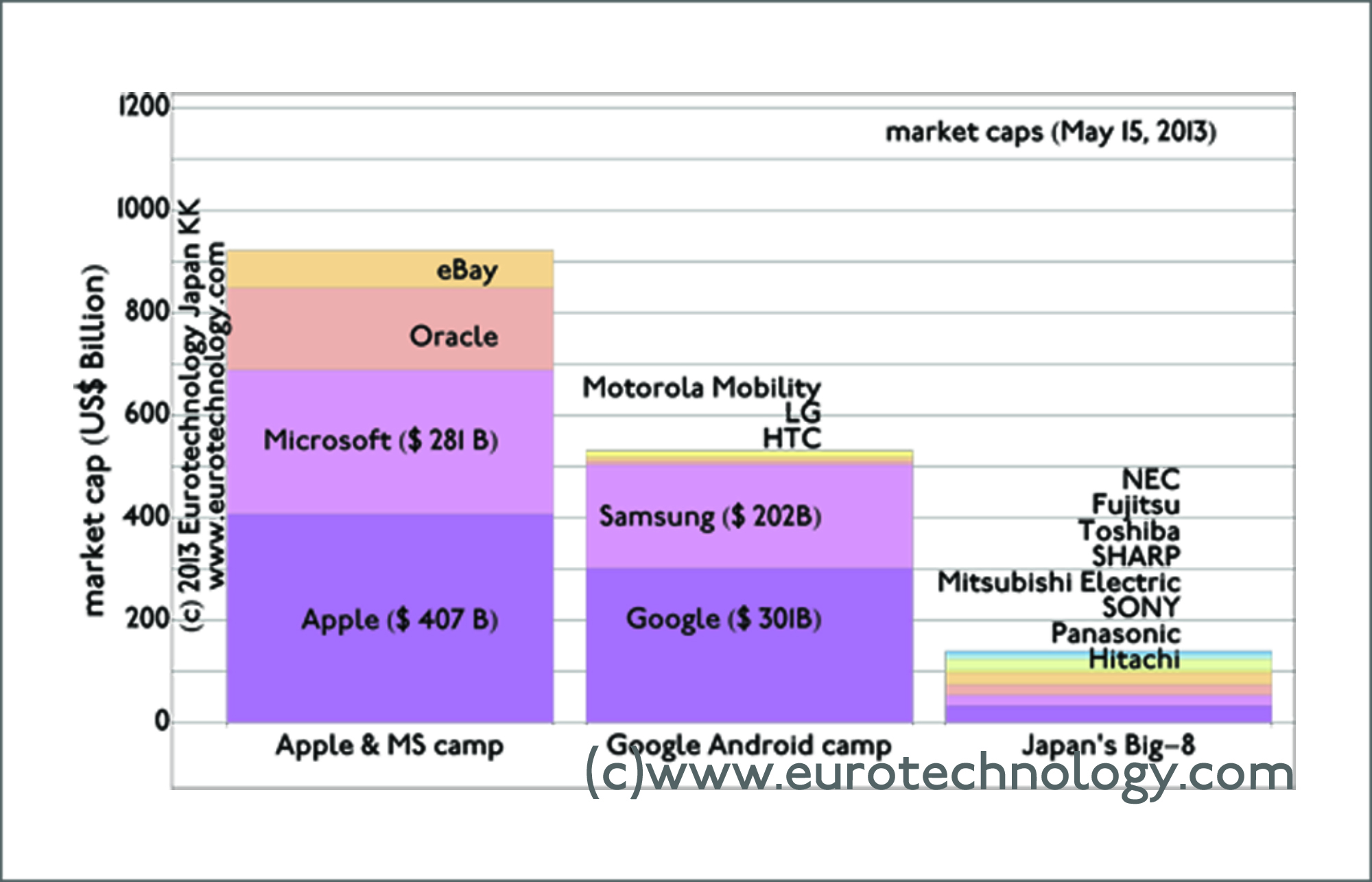

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…

-

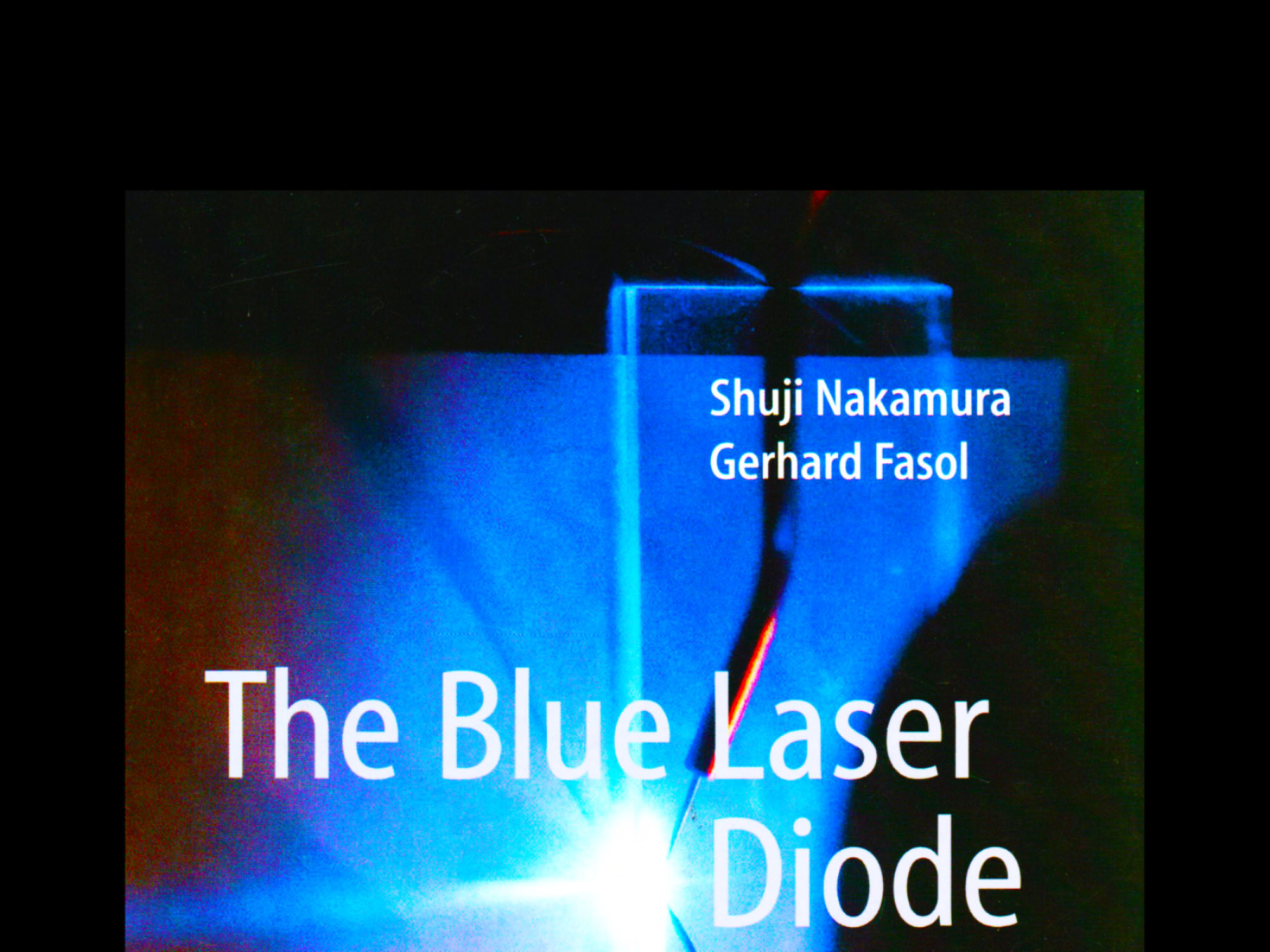

Blue laser diode book with Shuji Nakamura – the back ground story

The Blue Laser Diode: The Complete Story (2nd Edition) Springer Verlag, Heidelberg Blue laser diode book – GaN based light emitters and lasers (1st Edition) Since I have been working for many years on GaAs research, as soon as I heard Shuji Nakamura’s talk at one of Japan’s applied physics conferences, I understood the importance,…

-

Japan Cloud computing impact and trends

Japan cloud computing impact and trends, keynote article Software eats everything, and cloud eats software… we all see a strong trend of all data and computing to move to “the cloud”, because if done well, managing data and computing in the cloud can be far cheaper than on computers and on storage that you or…

-

BBC interview about SONY earning results

Helped BBC with the article “Sony earnings boosted by weak yen and smartphone sales“

-

Japan technology companies – the future?

Japan technology companies – how to move to the future? Gave a talk to a group of about 50 CEOs of the Japan subsidiaries of global companies on the topic “A future for Japan’s tech companies?” I talked about the same issues as at the TTI-Vanguard Forum about a year earlier, and started again with…

-

SONY (manuscript invited by BBC, preparation for interview)

Games are 11% of SONY‘s sales – and currently 56% of SONY’s profits come from selling life insurance, consumer loans and financial products in Japan. Games are important, but are not going to make or break SONY at this time. Technical specs of the next Playstation need to be fantastic. Specs alone however have not…

-

Cash goes mobile and electronic. First to market in Japan and then what? (TTI-Vanguard conference keynote)

The organizers of the legendary TTI-Vanguard conference series organized a conference on “Futureproofing” in Tokyo, and invited me to give a keynote on Japan’s creativity and first-to-market for many technologies and business models, and Japan’s difficulties to capture global value from this creativity, a phenomenon often called “Japan’s Galapagos syndrome“. The organizers, and particularly the…

-

More Drastic Changes Needed at Sony (CNBC TV interview)

More Drastic Changes Needed at Sony (Airtime: Thursday, May 14, 2009) Read more about SONY and Japan’s electrical industry sector in our J-ELECTRIC report (pdf file) Read more about SONY and Japan’s electrical industry sector: http://www.eurotechnology.com/store/j_electric/ Copyright (c) 2013 Eurotechnology Japan KK All Rights Reserved

-

iPhone? iTunes/iPod phones?

There is a lot of discussions about whether Steve jobs is going to announce an iPhone or iPod-Phone at the Apple Computer Developer’s Conference in SF – according to the headline report on Saturday May 13th, 2006 in Nihon Keizai Shinbun ( the world’s largest business daily ) it’s already known since May this year…