Category: Corporate Governance

-

Corporate Governance Reforms in Japan, Swiss-Japanese Chamber of Commerce in Geneva

Gerhard Fasol: Corporate Governance Reforms: How the Way Japanese Corporations Take Decisions is Changing SJCC Swiss-Japanese Chamber of Commerce Friday 12 October 2018, 18:30-19:45, JETRO Office Geneva Prime Minister Abe’s corporate governance reforms are arguably one of the biggest success stories of his reform program to promote Japan’s economic growth. Japan’s Government in coordination with…

-

Corporate governance reforms: making Japanese corporations great again? Monday, May 28, 2018, 19:00-21:00 at CCIFJ

Corporate governance reforms: making Japanese corporations great again? Understanding how Japanese Boards of Directors function helps you close deals Monday, May 28, 2018, 19:00-21:00 at CCIFJ Stimulating Japanese companies’ growth is a key element of Prime Minister Abe’s economic growth policies. For companies to grow, management needs to be improved, Boards of Directors need to…

-

Corporate Governance Reforms in Japan, Gerhard Fasol at the Foreign Correspondents Club FCCJ 12 March 2018

Corporate Governance Reforms in Japan Monday, March 12, 2018, 12:00 – 13:30 at the Foreign Correspondents Club in Japan FCCJ While many Japanese corporations are still admired around the world, too many have for years suffered sluggish growth and low profitability. A string of corporate scandals and failures have shocked the pubic and corroded confidence…

-

Japanese Corporate Governance – The Inside Story: Gerhard Fasol and Sir Stephen Gomersall

Gerhard Fasol and Sir Stephen Gomersall Daiwa Anglo-Japanese Foundation, London, Tuesday 16 January 2018, 6:00pm Topic: Japanese Corporate Governance – The Inside Story Speakers: Gerhard Fasol and Sir Stephen Gomersall Program: Tuesday 16 January 2018, 6:00pm – 7:00pm, Drinks reception from 7:00pm Location: 13/14 Cornwall Terrace, Outer Circle (entrance facing Regent’s Park), London NW1 4QP,…

-

Corporate governance reforms in Japan

Corporate governance reforms are one of the key components of Abenomics, to improve economic growth in Japan Corporate governance reforms in Japan: talk at the OAG House in Tokyo, Wednesday 20 September 2017, 18:30-20:00 Wednesday 20 September 2017, 18:30-20:00 Talk: Gerhard Fasol: „Corporate Governance Reformen in Japan: Erfahrungen als Aufsichtsratsdirektor einer japanischen Firmengruppe“ Free of…

-

Corporate governance reforms in Japan – talk given at the Embassy of Sweden in Tokyo on 6 October 2016

Corporate governance reforms in Japan Changing the way Japanese corporations are managed: Can it make Japanese iconic corporations great again? A talk by Gerhard Fasol at the Embassy of Sweden organized by the Embassy of Sweden, The Swedish Chamber of Commerce in Japan (SCCJ), and the Stockholm School of Economics Abstract: Changing the way Japanese…

-

Japan’s globalization paradox: is Japan global? or struggling to globalize?

Japan’s globalization puzzle: intriguing questions by one of my great European friends, a great European banking sector leader How do you explain Japan’s lack of internationalization with so many big Japanese holdings managing successfully businesses abroad (e.g. Toyota, Toshiba, Mitsubishi, etc.) Japan’s globalization paradox – a closer look Its not so simple: Japan is a…

-

Corporate governance in Japan – views of an Independent Board Director of a listed Japanese Company

Prime Minister Abe urges reform of corporate governance Slow but steady change… Reuters reports that Japan’s Prime Minister Abe urges company boards to reform corporate governance to include independent directors. I added the following comment. Corporate governance in Japan: exercise of shareholder power and emergency situations The question of independent Board Directors is often framed…

-

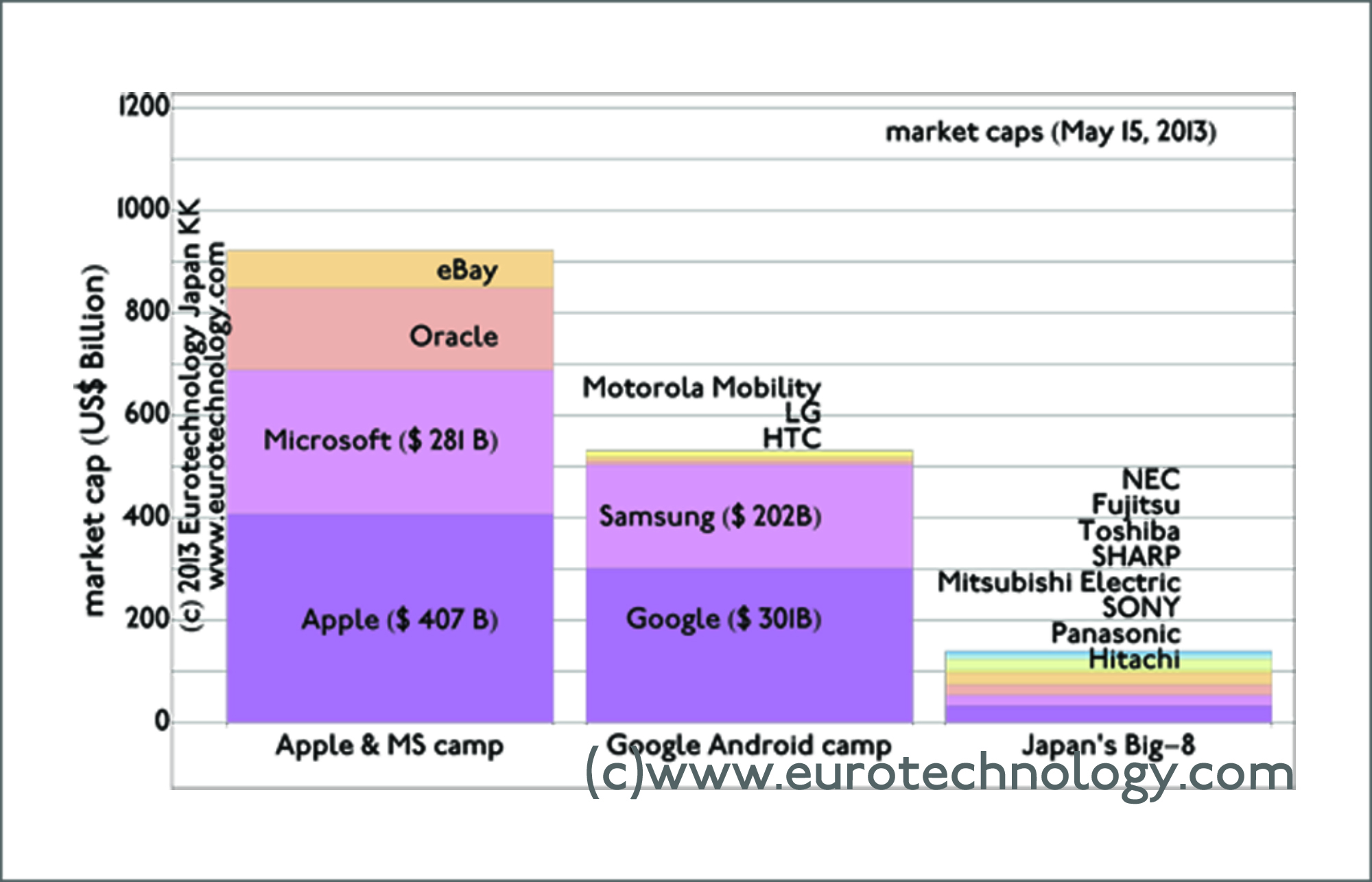

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…