Category: Galagapos effect

-

Japan’s future. Bill Emmott and Gerhard Fasol, a discussion.

Japan’s future: Bill Emmott and Gerhard Fasol Bill Emmott is an independent writer and consultant on international affairs, board director, and from 1993 until 2006 was editor of The Economist. http://www.billemmott.com Gerhard Fasol is physicist, board director, entrepreneur, M&A advisor in Tokyo. https://fasol.com/ Japan’s future: A conversation Bill Emmott: I came first to Japan in…

-

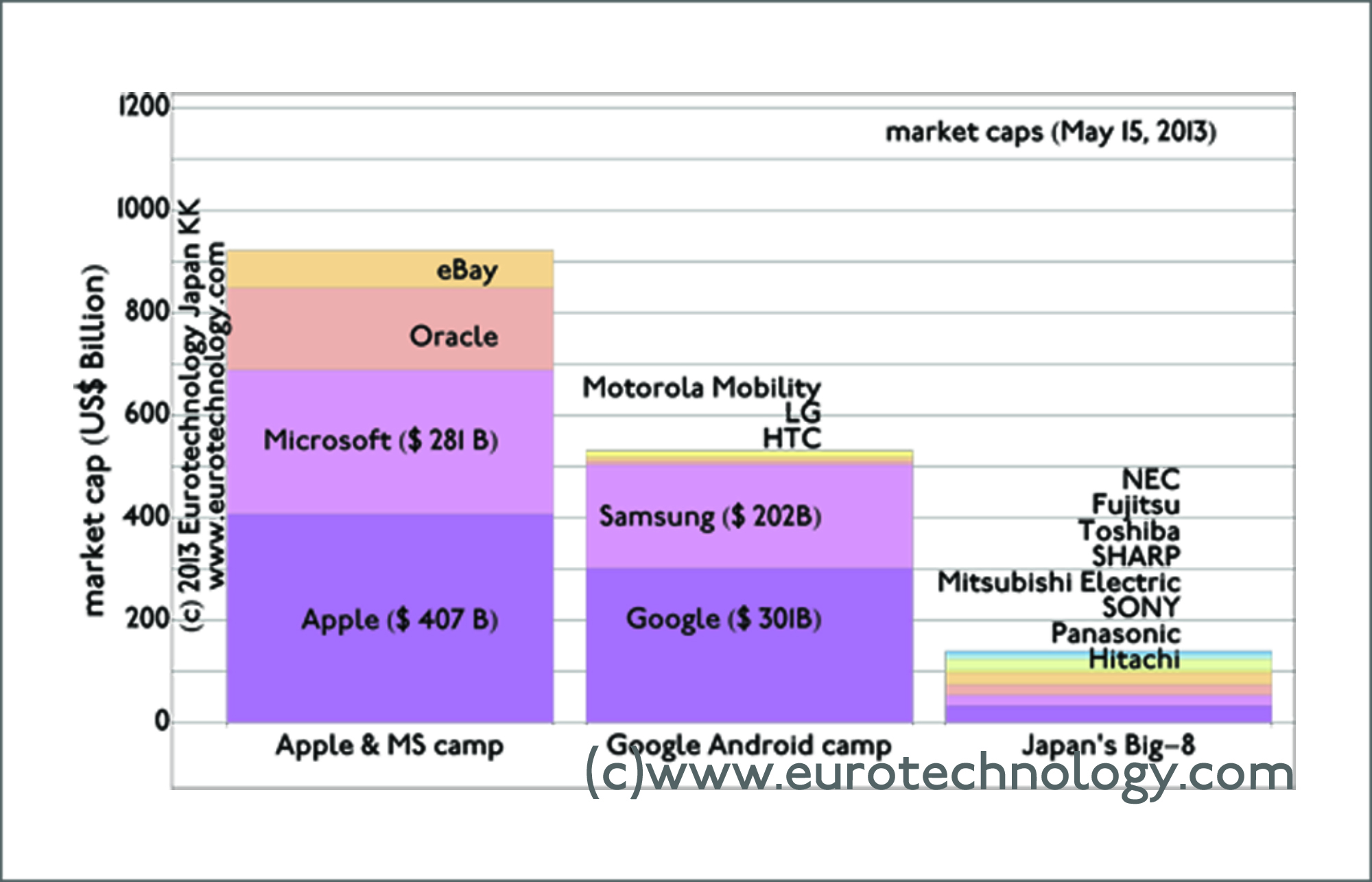

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…

-

Japan Galapagos Effect – How to capture global value for Japan? Keynote for the American Chamber of Commerce in Japan (ACCJ) by Gerhard Fasol

Japan Galapagos Effect – how to capture global value for Japan. From the Journal of the American Chamber of Commerce in Japan (ACCJ), reproduced with permission. Dr. Gerhard Fasol dissects the history behind Japan’s unique international market separation By Hugh Ashton Originally posted by ACCJ Journal on January 15, 2011 in “Chamber Events” based on…

-

Japan technology companies – the future?

Japan technology companies – how to move to the future? Gave a talk to a group of about 50 CEOs of the Japan subsidiaries of global companies on the topic “A future for Japan’s tech companies?” I talked about the same issues as at the TTI-Vanguard Forum about a year earlier, and started again with…

-

Cash goes mobile and electronic. First to market in Japan and then what? (TTI-Vanguard conference keynote)

The organizers of the legendary TTI-Vanguard conference series organized a conference on “Futureproofing” in Tokyo, and invited me to give a keynote on Japan’s creativity and first-to-market for many technologies and business models, and Japan’s difficulties to capture global value from this creativity, a phenomenon often called “Japan’s Galapagos syndrome“. The organizers, and particularly the…

-

Why Japan is several years ahead of Europe in telecoms…

Briefing the EU Attaches at the EU Embassy in Tokyo about the reasons behind Vodafone’s departure from Japan The deeper reasons and background on why Vodafone failed in Japan Today (March 23, 2006) I was invited to brief the Technology Attaches of the Embassies of the 25 European Union countries here in Tokyo about Japan’s…

-

Why are keitai so hot in Japan?

Seminar announcement The European Institute of Japanese Studies (EIJS Academy in Tokyo) of the Stockholm School of Economics will hold a seminar in Tokyo-Marunochi on Thursday, February 16, 2006: Topic: “Why are Mobile Phones (Keitai) so hot in Japan? – and How European companies in all sectors can profit from Keitai” Speaker: Gerhard Fasol Agenda:…

-

“New Opportunities versus Old Mistakes: European Companies in Japan’s High-Tech World”

Gerhard Fasol gave a talk at the EU-Japan Center for Industrial Cooperation (Tokyo) on Thursday, June 22nd, 2000, 14:00-16:00, and Thursday, December 7th, 2000, 14:00-16:00 Topic: “New Opportunities versus Old Mistakes: European Companies in Japan’s High-Tech World” (Audience: 70 Presidents, VPs, and managers of Japan subsidiaries of European Companies and Banks.)

-

New Opportunities versus old Mistakes: foreign companies in Japan’s high-tech world

Gerhard Fasol gave a 2-3 hour executive training course for the Chalmers Advanced Management Programs (Chalmers University of Technology, Göteborg, Sweden) Title: “New Opportunities versus old Mistakes: foreign companies in Japan’s high-tech world” Executive training course in Global Technology Management for General Managers, Chief Engineers, Managing Directors, Vice Presidents of major Swedish corporations and multi-nationals…

-

Foreign companies in Japan’s high-tech markets: new opportunities versus old mistakes (Lecture at Stanford University)

Success stories vs failure. Why some foreign companies succeed in Japan’s high tech sector, and why others fail. Stanford University Japan Technology Center lecture by Gerhard Fasol, given in 1999 – most still applies today! New opportunities vs old mistakes – foreign companies in Japan’s high-tech markets Stanford University lecture, given on October 28th, 1999…