Tag: fujitsu

-

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

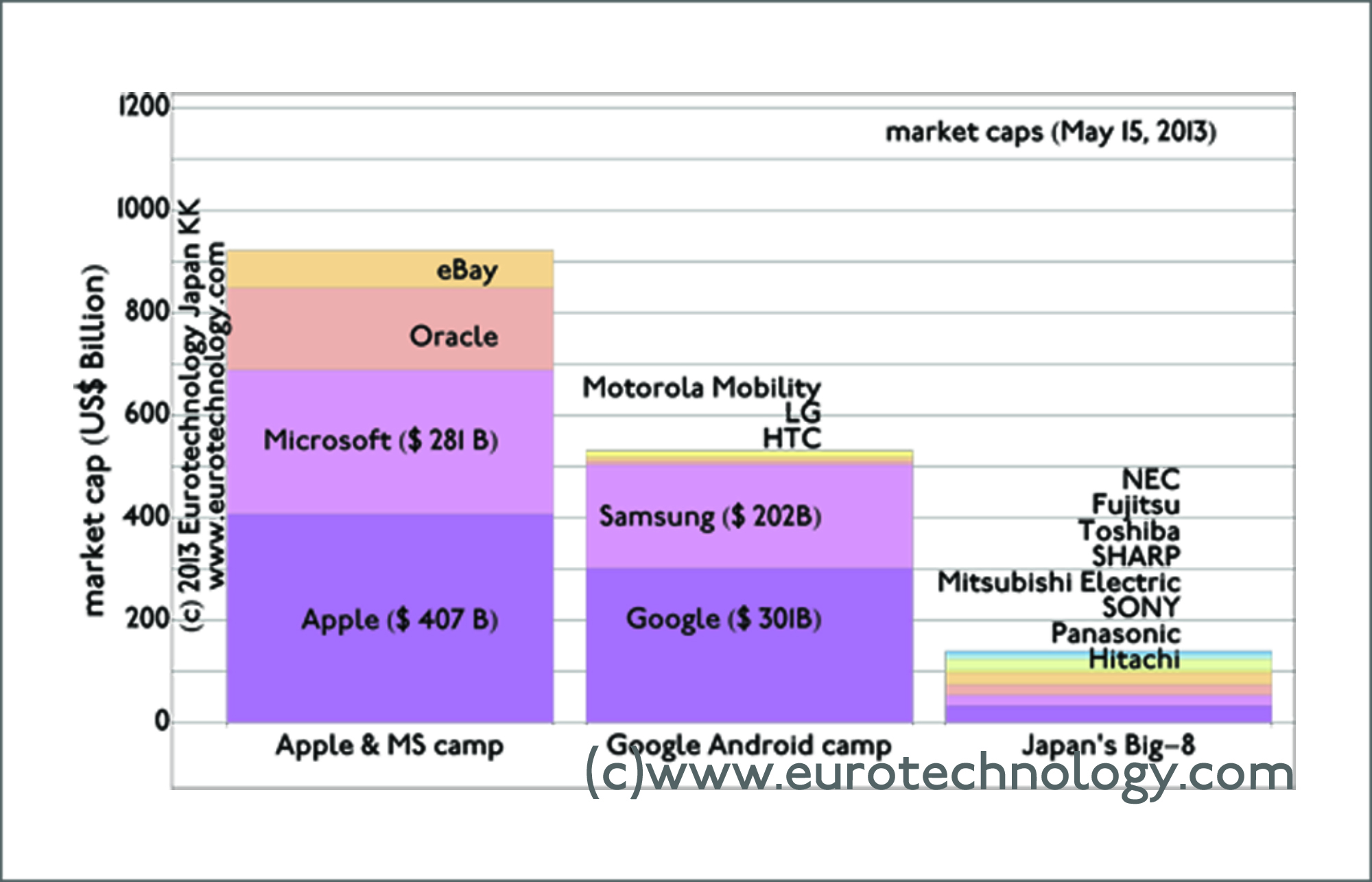

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…

-

e-Access and Lucent announce HSDPA tests in Japan

Sachio Semmoto, Founder and Chairman of eAccess and eMobile announces HSPDA tests in Japan eAccess / eMobile announces cooperation with Lucent e-Access Chairman & CEO, Sachio Semmoto and Lucent Chairman & CEO Patricia Russo on March 30, 2005 in Tokyo, explained their joint tests of HSDPA services in Tokyo. e-Access is preparing to enter Japan’s…