Category: Economy

-

Struggling for Europe’s technology sovereignty – a comment on Hermann Hauser’s proposal for a €100 billion Technology Sovereignty Fund

by Gerhard Fasol Hermann Hauser in a recent article on Project Syndicate, entitled “The Struggle for Technology Sovereignty in Europe” argues for “the UK and EU to jointly establish a €100 billion ($120 billion) Technology Sovereignty Fund to counter the $100 billion that the US is spending on its technology sovereignty and the even larger…

-

Hermann Hauser: about the Cambridge venture ecosystem

Hermann Hauser is co-founder of Acorn Computers, Advanced RISC Machines (ARM) and arguably the most distinguished leader of Cambridge’s Venture Ecosystem. Recording of the video discussion: On Thursday 17 September 2020 at 6pm we will meet in central Tokyo. Hermann Hauser- Europe’s venture capital pioneer, and co-founder of ARM and many other companies and investor…

-

Japan’s future. Bill Emmott and Gerhard Fasol, a discussion.

Japan’s future: Bill Emmott and Gerhard Fasol Bill Emmott is an independent writer and consultant on international affairs, board director, and from 1993 until 2006 was editor of The Economist. http://www.billemmott.com Gerhard Fasol is physicist, board director, entrepreneur, M&A advisor in Tokyo. https://fasol.com/ Japan’s future: A conversation Bill Emmott: I came first to Japan in…

-

Japan’s globalization paradox: is Japan global? or struggling to globalize?

Japan’s globalization puzzle: intriguing questions by one of my great European friends, a great European banking sector leader How do you explain Japan’s lack of internationalization with so many big Japanese holdings managing successfully businesses abroad (e.g. Toyota, Toshiba, Mitsubishi, etc.) Japan’s globalization paradox – a closer look Its not so simple: Japan is a…

-

Best wishes for 2015 from Tokyo!

The photograph shows the Gobelsburg Castle in Austria, you can see the location here on Google maps. A castle of this name is mentioned in 1178, and wine is grown in the region for about the last 1000 years. Thoughts and analysis for 2015 Abenomics?! The trick of course is the third arrow, the reforms.…

-

Briefing the Trade Minister of Sweden, Dr. Ewa Björling, on Japan’s energy sector (22 Nov 2013)

Lunch today (22 Nov 2013) with the Trade Minister of Sweden, Dr. Ewa Björling, chaired by the Ambassador of Sweden. Was asked to brief Minister Björling and a delegation of Swedish CEOs about Japan’s energy sector. Gave Minister Björling a 20 minutes presentation followed by discussion. Dr. Ewa Björling is extremely impressive, she is dentist,…

-

Abenomics success probability is 12%, 88% probability of failure (Professor Takeo Hoshi, Stanford University)

Professor Takeo Hoshi, Professor of Economics at Stanford, about Abenomics success probability Why did Japan stop growing after completing the catch-up with advanced countries? Takeo Hoshi, Professor at Stanford University, who devotes his life to work on Japan’s economy at US Universities, gave a talk at the Swedish Embassy organized by the Stockholm School of…

-

Japanese management – why is it not global? asks Masamoto Yashiro at a Tokyo University brainstorming

Lecture summary written by Gerhard Fasol, with revisions by Mr Masamoto Yashiro. All Rights Reserved. Masamoto Yashiro: Japan leader and Chairman emeritus of Esso, Exxon, Citibank, Shinsei Bank, Board Director China Construction Bank Masamoto Yashiro at brainstorming by President of Tokyo University Masamoto Yashiro is a legend in Japan’s banking and energy industry. He built…

-

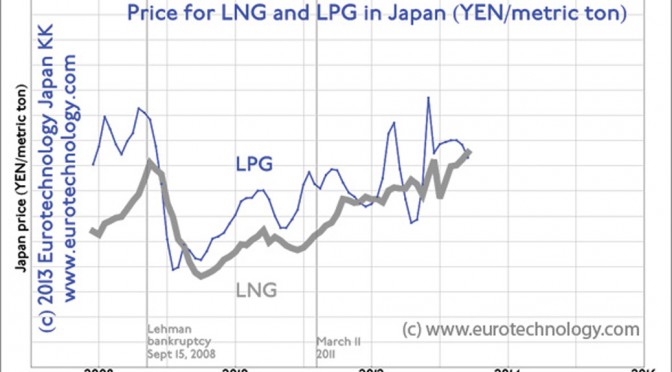

Pricing of gas imports – Why does Japan pay so much more than any other major country for gas imports?

Was invited today to take part in a discussion meeting at one of the European Embassies about pricing of Gas (LNG) imports. All the major Japanese buyers of LNG from the major electricity and gas companies came together with European partners to discuss issues of import Gas (LNG) pricing. For detailed statistics of Japan’s gas…

-

Japan Galapagos Effect – How to capture global value for Japan? Keynote for the American Chamber of Commerce in Japan (ACCJ) by Gerhard Fasol

Japan Galapagos Effect – how to capture global value for Japan. From the Journal of the American Chamber of Commerce in Japan (ACCJ), reproduced with permission. Dr. Gerhard Fasol dissects the history behind Japan’s unique international market separation By Hugh Ashton Originally posted by ACCJ Journal on January 15, 2011 in “Chamber Events” based on…