Category: business

-

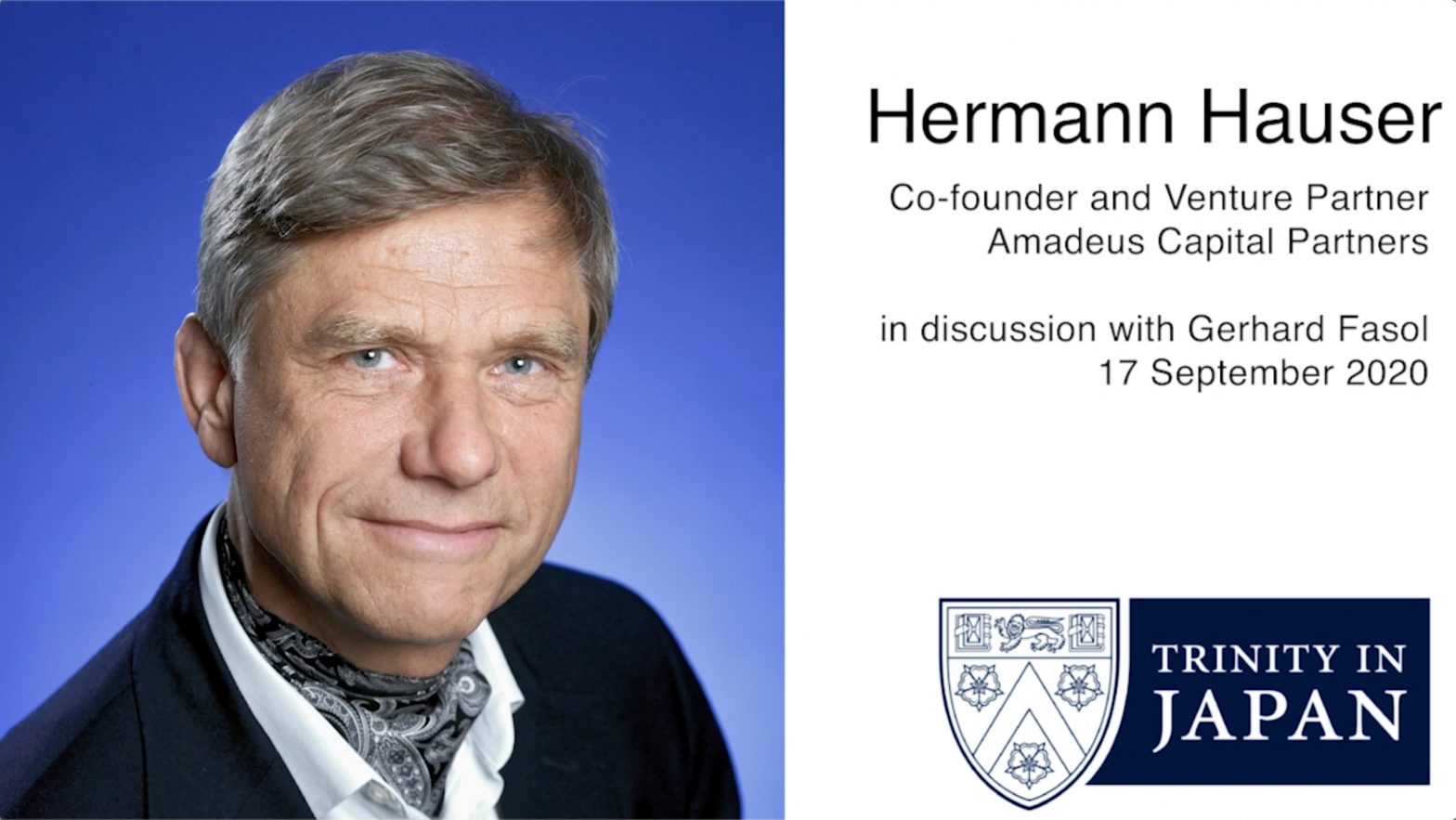

Struggling for Europe’s technology sovereignty – a comment on Hermann Hauser’s proposal for a €100 billion Technology Sovereignty Fund

by Gerhard Fasol Hermann Hauser in a recent article on Project Syndicate, entitled “The Struggle for Technology Sovereignty in Europe” argues for “the UK and EU to jointly establish a €100 billion ($120 billion) Technology Sovereignty Fund to counter the $100 billion that the US is spending on its technology sovereignty and the even larger…

-

Corporate governance reforms: making Japanese corporations great again? Monday, May 28, 2018, 19:00-21:00 at CCIFJ

Corporate governance reforms: making Japanese corporations great again? Understanding how Japanese Boards of Directors function helps you close deals Monday, May 28, 2018, 19:00-21:00 at CCIFJ Stimulating Japanese companies’ growth is a key element of Prime Minister Abe’s economic growth policies. For companies to grow, management needs to be improved, Boards of Directors need to…

-

Japanese Corporate Governance – The Inside Story: Gerhard Fasol and Sir Stephen Gomersall

Gerhard Fasol and Sir Stephen Gomersall Daiwa Anglo-Japanese Foundation, London, Tuesday 16 January 2018, 6:00pm Topic: Japanese Corporate Governance – The Inside Story Speakers: Gerhard Fasol and Sir Stephen Gomersall Program: Tuesday 16 January 2018, 6:00pm – 7:00pm, Drinks reception from 7:00pm Location: 13/14 Cornwall Terrace, Outer Circle (entrance facing Regent’s Park), London NW1 4QP,…

-

Japan’s globalization paradox: is Japan global? or struggling to globalize?

Japan’s globalization puzzle: intriguing questions by one of my great European friends, a great European banking sector leader How do you explain Japan’s lack of internationalization with so many big Japanese holdings managing successfully businesses abroad (e.g. Toyota, Toshiba, Mitsubishi, etc.) Japan’s globalization paradox – a closer look Its not so simple: Japan is a…

-

How can a European company succeed in Japan’s energy landscape? (EU-Japan Gateway keynote)

I was invited to give a keynote talk to about 50 European participants in the EU-Japan Gateway program, which assists small and medium sized European companies to enter the Japanese market. My topic was “How can a European company succeed in Japan’s energy landscape?” I explained Japan’s energy situation today, based on our reports: Renewable…

-

Cash goes mobile and electronic. First to market in Japan and then what? (TTI-Vanguard conference keynote)

The organizers of the legendary TTI-Vanguard conference series organized a conference on “Futureproofing” in Tokyo, and invited me to give a keynote on Japan’s creativity and first-to-market for many technologies and business models, and Japan’s difficulties to capture global value from this creativity, a phenomenon often called “Japan’s Galapagos syndrome“. The organizers, and particularly the…

-

Will cash become obsolete? E-money, mobile payments and mobile commerce (Talk for the American Chamber of Commerce in Japan)

Gave presentation to the Telecommunications Committee of the American Chamber of Commerce in Japan (ACCJ) on October 7, 2009. My talk was attended by about 30-40 executives from major global telecom operators, global banks, new-age payment companies, and from major internet companies. Outline: What is money? Medium of exchange Unit of account Store of value…

-

“New Opportunities versus Old Mistakes: European Companies in Japan’s High-Tech World”

Gerhard Fasol gave a talk at the EU-Japan Center for Industrial Cooperation (Tokyo) on Thursday, June 22nd, 2000, 14:00-16:00, and Thursday, December 7th, 2000, 14:00-16:00 Topic: “New Opportunities versus Old Mistakes: European Companies in Japan’s High-Tech World” (Audience: 70 Presidents, VPs, and managers of Japan subsidiaries of European Companies and Banks.)

-

New Opportunities versus old Mistakes: foreign companies in Japan’s high-tech world

Gerhard Fasol gave a 2-3 hour executive training course for the Chalmers Advanced Management Programs (Chalmers University of Technology, Göteborg, Sweden) Title: “New Opportunities versus old Mistakes: foreign companies in Japan’s high-tech world” Executive training course in Global Technology Management for General Managers, Chief Engineers, Managing Directors, Vice Presidents of major Swedish corporations and multi-nationals…