Tag: Toshiba

-

Japan’s globalization paradox: is Japan global? or struggling to globalize?

Japan’s globalization puzzle: intriguing questions by one of my great European friends, a great European banking sector leader How do you explain Japan’s lack of internationalization with so many big Japanese holdings managing successfully businesses abroad (e.g. Toyota, Toshiba, Mitsubishi, etc.) Japan’s globalization paradox – a closer look Its not so simple: Japan is a…

-

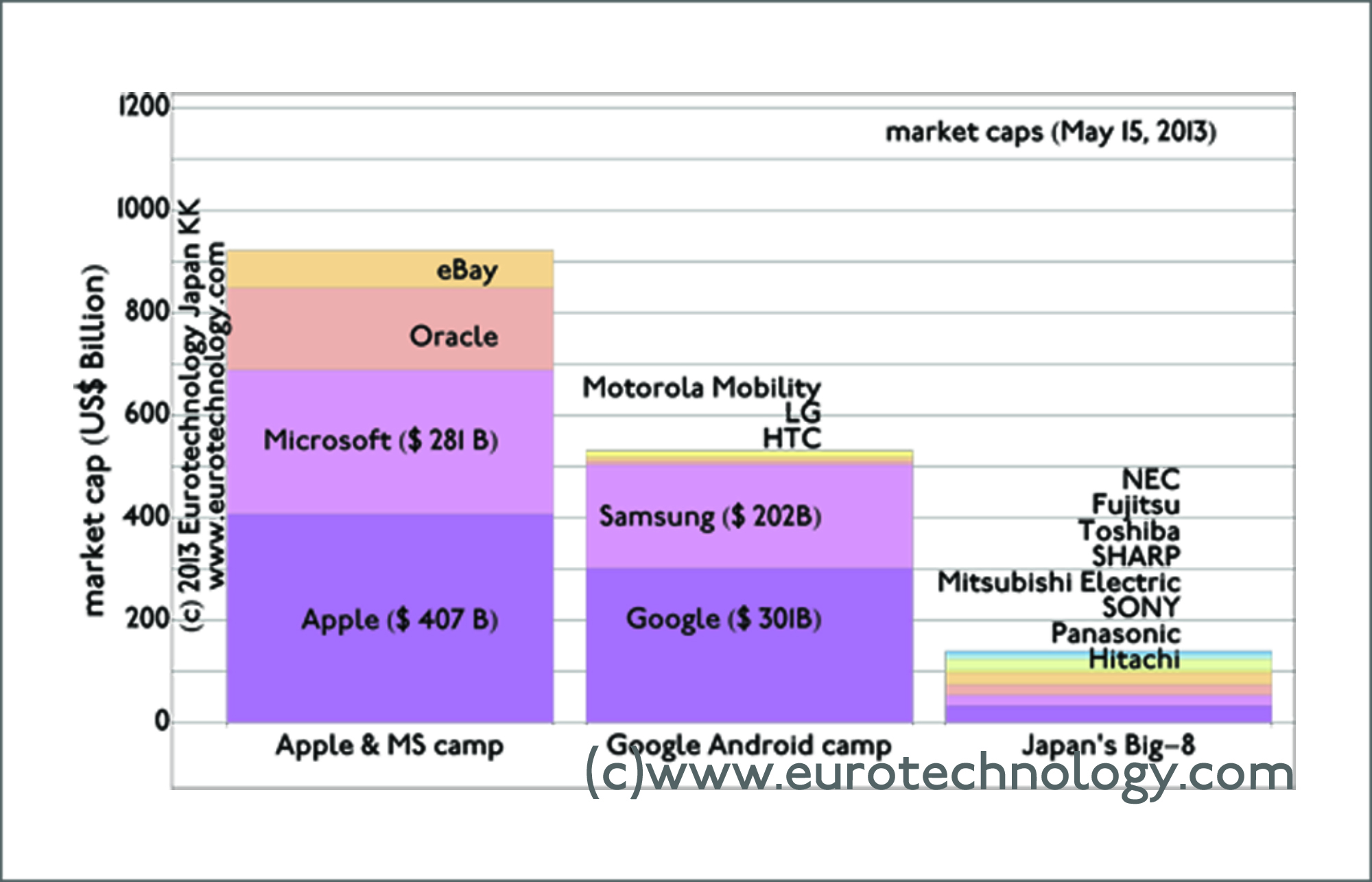

Japan’s electronics conglomerates: Whats the difference between Apple/IBM vs Sony/Panasonic/NEC?

Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Need for corporate governance reforms in Japan My friend’s question: Why are Apple/IBM/Microsoft/Google so very different compared to SONY/Panasonic/NEC Gerhard Fasol’s answer: Profit and growth. Apple and IBM grow and are highly profitable. Sony, Panosonic and NEC have no growth and no profit for 15 years…